Maybe while we were married we could afford to let a little money ‘go missing’ or be ‘stolen’ from our wallet but things change when we get divorced. If you’re a single parent, you’re likely on a budget or at the very least cognizant of where your pennies are going. Maybe you just want to tighten up your expenses a little. I can think of 10 ways our money disappears into thin air without any tangible benefits and I’m as guilty as the next mom for letting it happen…so, beware of these 10 hidden money stealers;

1) Paying for credit cards, reward cards or loyalty cards-You should never have to pay for cards, memberships for retail outlets if you are on a strict budget. Those small monthly charges add up over the year without adding any value to your life or budget.

Instead: Try to find credit card companies that offer cash back rewards. Depending on how much you spend and PAY off your balance every month, you can earn $$$ back on your total purchases. I use Visa Rewards and it doesn’t cost a cent for the card, yet at the end of each year I receive cash back which automatically cancels expenses on my December statement. Sweet. Also, any retail outlet that charges a membership fee, ask yourself whether it’s really worth it.

2) Paying full price for any clothing or accessory-I know, sometimes we can’t resist. It’s the last one in your size and you’ve been waiting for a year to invest in it (handbag, shoes, dress) but the fact is anything at full retail price in a boutique or department store is grossly over priced and does not correlate to the product quality.

Instead: Wait for a sale. Be patient. At the end of each season your coveted item will likely be 50% off and more reasonable price range. Also, know some alternative shopping outlets that have designer brands for half the price of large department stores.

3) Buying in bulk-It seems like a good idea at the time. You’re buying more but paying less per unit. The problem is you’re spending a great deal on products that you’re taking a year or more to use up. I remember going through a phase of buying in bulk at Costco. Case in point, we bought a huge pack of Baking Soda with multiple individual boxes. It makes me laugh now because as many uses as we can find for baking soda, trust me a package that size will last forever and ever. It will fall out of your pantry every time you open the door.

Instead: Buy what you need and will use in the next month at a sale price. Whether that’s at your local pharmacy or grocers, they always have sales so buy when those offers are on without having to spend years worth on cleaning products, you free up your budget (and storage space) for other necessities.

4) Making purchases because they’re on sale-Guilty! Raises hand, lowers eyes in shame. I LOVE a sale but I’ve also learned the hard way. The discount on products gets us focusing on the savings while ignoring the fact that we may not need this item. Why spend even $10 on something we don’t need just because it’s a great bargain.

Instead: Be conscious while sale shopping and always ask yourself “Would I buy this at full price?” If the answer is no, then why buy it on sale?

5) Grocery shopping while hungry-I do this all the time and I confess that I end up with items in my kitchen cabinets that I wonder what possessed me. Or else, I simply buy too much and end up throwing away food.

Instead: Make your list ahead of time and think about what you’re going to cook for your kids before going to the store. You’ll get just the right amount and resist the urge to spontaneously purchase overpriced, prepackaged food.

6) Hotel fees and charges-Often when we book our hotel room, we get a base price/night but what they don’t tell you about are all the charges they’re going to add on. Obviously, taxes are non-negotiable but often if you inquire about the charges before reserving your room, you can get them to remove some of the more ambiguous fees reducing your bill up to $20/ night. Yes, those pesky fees add up.

Instead: Negotiate the fees at the time of booking. Also, get the Hotels Tonight app where hotel rooms that are not at maximum occupancy will deeply discount their remaining rooms for last minute bookings.

7) Ordering a $4 coffee and leaving a $1 tip-Stop that. It’s a 25% tip for someone to make you a coffee. It’s off balance.

Instead: Leave a smaller tip. Think percentage vs. effort. That ratio still applies even at the fancy coffee shop.

8) Waiting until the last minute to book a flight-Last minute prices are always inflated (the opposite of hotels, for the most part).

Instead: Plan ahead. Usually two months ahead will render the best deals. Free air mile plans that allow you to contribute to future flights can also be beneficial if you are travelling a great deal.

9) Being over insured– Insurance companies have a sneaky way of increasing your premium upon your annual renewal—for the exact same coverage. Plus, do you still require that life insurance policy or are you throwing away $100/month? Again, depending on your current needs, life insurance may not be required.

Instead: Review your insurance needs (medical, auto, home, life) every year or two and make necessary adjustments to avoid paying for coverage you don’t need.

10) Lazy money-Letting your savings account sit idle without earning any interest. This is like throwing money out the window because so long as the interest rate is lower than inflation, our money is depreciating in savings accounts. I think fear of the unknown holds us back when it comes to investing our savings. We have been exposed to popular culture where rip off scams, get rich quick schemes, and stock market crashes are featured and put the fear into us. The reality is, investing our money isn’t as drastic as all that and there are secure ways to do it. It’s a question of brushing up on investment terms and finding a reputable investment firm.

Instead: Make your money work for you. Look into investing the money in bonds, commercial REITS (real estate investment trusts) or other low risk investments. Start reading blogs like this to learn more. In fact this particular post summarizes it quite well. Talk to an investor who is independent from your bank (where they tend to push mutual funds that they earn returns on). You want an independent advisor and one who will tailor your investor profile to your needs. That may be ‘low risk’ but as long as your returns on the investment are greater than the bank’s rate, you’re winning.

So, beware the money stealers because these 10 things will take your cash before you can blink. Making these simple corrections by being aware, can really make a difference in your annual budget and savings.

What did I miss? Any other hidden money stealers you can think of?

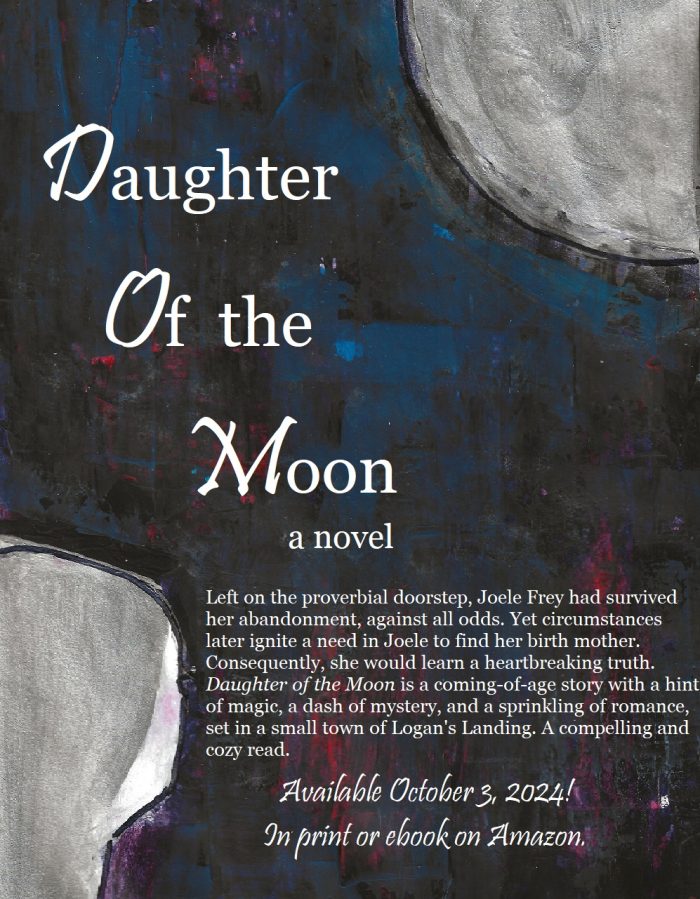

For more great tips—get the book:

Amazon.ca and Amazon.com

Comments are closed.

Design by ThemeShift.

My Inner Chick

September 24, 2016 at 6:40 amGreat tips.

My girlfriend is going thru all of this presently.

No more fancy jeans…No more restaurants.

It’s quite a BIG change for her.

xxx

lisa

September 24, 2016 at 8:41 amThanks, Kim. It really is a big change for most but it’s doable. Fancy jeans are over rated 😀 Levi’s work quite well.

Vishnu

September 18, 2016 at 3:27 pmGreat tips, Lisa. Similar to don’t go to the grocery store hungry, don’t go to restaurants hungry either 🙂 Eat something before you go and go to enjoy the company. haha And return with any leftovers for your next day’s meal 🙂

I am a minimalist so not only save in the ways you’ve mentioned above but keep my spending to a very minimum. I know that we are at war with savvy retailers and corporations who are trying to get us to live big and buy more 🙂 Every decision in a store (many many strategic ones) are made with the simple goal of getting us to get more!

lisa

September 20, 2016 at 9:02 amThat’s a good idea, Vishnu. I sometimes will have a healthy snack before dinner out with a large group. Reason being it’s usually a long wait for orders and sometimes the restaurant isn’t very good. “We are at war with savvy retailers…” so true. Being cognizant of that while shopping is key. Thanks for sharing your tips, Vishnu!

Charlotte Klein

September 16, 2016 at 9:30 amI feel like I need to bookmark this, staple it to my forehead, tape it to my fridge, and place it on my mirror. YES. I am also guilty of buying things when they aren’t on sale (no patience) or buying things just BECAUSE they are on sale… but then finding I have no use for it. Or (to give a recent example) buying 2-for-1 cans of vegan tuna (which is just as gross as it sounds) at Whole Foods, because I’d like to try something new. This time however, I’m going to return one of those cans because holy vomit.

LOL, thanks for this!! XOXO

lisa

September 17, 2016 at 9:55 amMe, too Charlotte. I’ve learned to ask myself that question though, while sale shopping. It’s easy to make reasons why we’ll use or need something so have to be aware of that trap. 2 for 1’s are tempting. Vegan tuna? Sounds far too healthy for me 😉 Good for you for returning it. It takes effort and time to return things and instead we often just absorb the loss and give away or throw out the item. Glad you found this post helpful.

Marcia @ Menopausal Mother

September 9, 2016 at 6:34 pmThese are all so true! Grocery shopping while hungry—GUILTY here!! And it is a disaster when I get to the checkout and ring up the bill.

lisa

September 11, 2016 at 3:22 pmRight? I buy cookies (the expensive bakery kind), chocolate bars, deli items …and can’t possibly eat it all. Not to mention, unhealthy choices. Although I often regret the ‘healthy’ cookies I buy and throw away cause they taste lousy.

Liv

September 9, 2016 at 6:15 pmMy husband is big on bulk. We have enough toilet cleaner to last until the kids are in college now…

Great post Lisa!

lisa

September 11, 2016 at 3:20 pmLOL—Liv. Everyone has a ‘thing’ they like to stock up on. 🙂

Ellen

September 9, 2016 at 5:01 pmYou have no idea what a service you performed with this post today. Having been there done that bought the T-shirt, I can relate to all of these. Another one I might add is going to the library to get books and read magazines, or even checking out artwork to decorate the apartment. I never turned down free castoffs, either, and that is when I learned to make it over make it do. I have photos of myself wearing a dress that retailed for several hundred dollars which was on a final clearance rack at The Denver for $18. It was kind of sad with a ripped hem and broken zipper and a stain on the front. It looked like someone had a rough night in it, but I took it home, fixed all the broken parts and sent it to the cleaners. It came back looking great, and I wore it to weddings, etc., for a couple of years. Same deal with a pair of black silk coulottes (remember those??) WE learn to get really thrifty when we have to. The worst I was ever ripped off was probably when an attorney at the firm where I worked set me up with an insurance agent (a friend of his) and I bought a “whole life” insurance policy. He said it was like a savings account, and in five years I could cash it in for most of what I had paid for it. Surprise! When I tried to do that, I was informed that Mr. Moffatt was no longer with the company, and that just was not true. The policy was worthless. I was counting on that to help my son with college expenses. For five years I had paid $100 a month, thinking that I would have $6000 to get him started that first year. Money down the freaking drain!

Sorry this is so long, but your post really resonated with me.

lisa

September 11, 2016 at 3:19 pmHi Ellen, Oh, my gosh! You were ripped off by the insurance agent and the attorney because he should know better. This makes me so mad. I’m sorry you were cheated out of your hard earned money!! Thanks for sharing that though because it’s a warning to others about checking into companies and reading the fine print.

As for that dress, that is awesome! You are so resourceful and talented. It shows on your blog with your many successful DIY projects. Thanks for sharing here, Ellen 🙂

Balroop Singh

September 9, 2016 at 12:20 pmThose are wonderful tips Lisa! Marketing Gurus try their best to entice us but we have to shop wisely. Have you seen where they put the chocolates? And yes! NEVER go grocery shopping when hungry! 🙂

lisa

September 9, 2016 at 3:17 pmThank you, Balroop. Marketing gurus have us believe we ‘need’ all kinds of things we can live without. They’re constantly solving non existent problems, so we’ll buy their product.

Tamara

September 9, 2016 at 11:15 amWhile I can’t resist overtipping (I used to deliver pizza) I’m so guilty of #5 even worse!

As for bulk stores, it sort of cracks me up. For a party, it’s one thing. But when I go and see people loading their carts with gigantic boxes of things, I do wonder if they’ll really go through that much food before it expires??

lisa

September 9, 2016 at 3:16 pmI feel guilty if I don’t tip enough and coffee barista is one where I try to put it into perspective. Right? If you’re having a big party by all means, buy up that baking soda—LOL. I bet most of it expires before they get to it. I guess we feel better if we have stored up food ‘just in case’. That’s one area we can easily cut back on without noticing.

Harleena Singh

September 9, 2016 at 1:13 amHi Lisa,

That’s great advice indeed 🙂

I was nodding my head in agreement as I read through, because it’s not just single parents, but others too who tend to overspend when we know we can easily save! Yes, after a divorce one’s got to be all the more careful and try saving every little bit – and I think you become conscious of a lot of things where money is concerned, which you weren’t earlier.

Thanks for sharing. Enjoy your weekend 🙂

lisa

September 9, 2016 at 3:14 pmExactly true, Harleena. These are just a few examples of money ‘leaking’ from our savings without even noticing. Saving is the ultimate end goal, for sure. have a great weekend!

Jane Thrive

September 8, 2016 at 6:54 pmGreat advice, Lisa!!! 🙂 I guess I should follow up that buying coffee at starcrack is a total money-drain–instead make at home and bring it in an enclosed mug!!

That said, I buy iced tea there all the time and feel guilty about it. LOL.

Also, if working, pack a lunch instead of splurging on the $10/lunches out there, that adds up to $50/week and times 52 weeks…well…you could be saving lots that way, too.

p.s. i’m also guilty of buying lunches, but trying to be better about it!

xoxoxo!!! 🙂

lisa

September 9, 2016 at 11:22 amWell, I think if you’re getting something good out of that starcrack coffee then it’s worth the expense (within reason, obvi). It’s the stuff we lose our money to that add nothing to our life that really is a true waste. I LOVE buying a good latte at the local coffee shop. It’s a nice reprieve. Your’e right that those meals out add up fast. I guess limiting lunch splurges to twice a week instead of everyday, for example. That way you still get to enjoy it but without breaking your budget. I’m guilty of so many unnecessary expenditures, too. Sometimes I have to remind myself not to be wasteful.

Jeri

September 8, 2016 at 12:13 pmI got rid of my Costco card last year. It was silly to keep it once I became single, though I think I may still go in with a friend from time to time to stock up on a few products of theirs I truly love. Your comment about bulk baking soda reminds me of the huge box of Saltines I bought. They went stale far before I could finish them all, but that was in NC and humidity could have been a factor.

lisa

September 8, 2016 at 5:56 pmGood old Costco. Loved that place but just like you, I had no reason to buy in bulk anymore. Good idea to go with a friend to have a look. How much do we really need and I find crackers go stale really fast here as well.

Chrys Fey

September 8, 2016 at 11:57 amI’ve always been super cautious with my money. I’m not a big spender, I hate having to charge a credit card, I only buy clothes on sale and only the food I need. I’ve been that way my whole life after difficult money times growing up. At least those hardships made me responsible. 🙂

lisa

September 8, 2016 at 5:54 pmThat’s impressive, Chrys. I bet even if you had lots of money you would continue similar discipline. You could have written this post—lol.